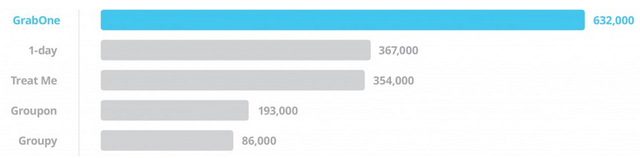

Source: Nielsen Online Ratings Monthly Average March 2014 – Feb 2015

Interesting data from Nielsen released earlier this year (via the GrabOne Blog) shows GrabOne is still far out ahead of the pack in terms of kiwi daily deal websites. From this data and some other sources I have extrapolated some website visitor market share figures for 2015.

Daily Deals and Vouchers Market Share in New Zealand (Website Visitors)

GrabOne 32%

1day 19%

TreatMe 18%

Groupon 10%

Other 21%

Key Takeaways

These days all the Group Buying sites are also selling products (except 1day who don't sell vouchers) so you really have to look at all group buying and daily deals sites as one market.

Numbers supplied a few years ago from Shane Bradley had GrabOne at 65% market share. But this figure was for the voucher market which excluded 1day who had given up on vouchers. So if they had taken into account 1day the market share would have been a lot lower. Putting 1day in does change the numbers around from those older numbers.

I had never seen a traffic comparison between 1day and GrabOne. They were in different areas of the deals market, but is still good now to see how they compare. However traffic is not necessarily an indicator of sales. While GrabOne has almost double the traffic of 1day, 1day will have a higher order value compared to vouchers.

Vouchers tend to go for $25 to $100 where products on 1day go from $10 to $1500. Products command a higher price, so although the traffic is lower on 1day, the average order value is probably twice GrabOne meaning they are similar sized businesses. And this stacks up with reports from both GrabOne and the standalone 1day site with sales in the region of 80-100m per year.

Now that a lot of overseas websites are shipping to NZ does this mean that product daily deal sites have less impact than it used to? It's hard to say without seeking historical data, but this could be the case. The online market is fracturing with some many large international players starting to impact local kiwi sites.

With many offering free shipping to NZ, local sites have an uphill battle to stay relevant. It's a shame because local businesses make the NZ economy go round. If everyone is buying offshore there is less money going round, leading to less employment.

Overseas sites just see the NZ market as a place where they can make little or no margin, but more importantly for them, sell more volume and get cheaper prices from suppliers. They can undercut kiwis companies being from a larger market and NZ doesn't really matter to them. For NZ businesses, the local makret is everything to them. Interesting to see how it all plays out. NZ businesses have the fast shipping advantage so they need to get super fast at despatching.

Interesting to see that TreatMe is up to 1day's level of traffic. They have done an excellent job, and taking 1day into account, they are third. Or in terms of vouchers they are second. If I remember back to a few years ago, TreatMe was pegged at around 10% market share. Based on these current figures they are around 18% market share. Not a bad effort to double your business in 2 years in a tight market.

So if TreatMe has gained 8% that means others have given up market share. Obviously the little deals site would have lost some, The Daily Do Group (Daily Do/ Yazoom/Groupy) could have and likely Groupon. Did GrabOne lose any I wonder? Very hard to say without historical data. Either way TreatMe are growing well in an industry that hasn't really grown that much the past few years.

It seems starting late in NZ has meant Groupon has not been able to reach a dominant position like in other markets around the world. Number 1 in the US, Groupon in NZ is relegated to 4th position with just 10% of the market. Figures from a few years ago had them at 10% also so it seems they haven't had much growth.

What will happen next?

What will Groupon do? With flat revenue they have to decide their strategy going forward. Plod along, exit NZ, or make a go for it by acquiring DailyDo. That would give them a good shot at TreatMe. Then again maybe they should just buy TreatMe as it is privately owned and take GrabOne head on.

Will we see TreatMe overtake 1day in terms of visitors? They are so close now it may happen. Perhaps 1day should buy out TreatMe? The only thing about consolidation is less competition and less competition brings deals that aren't as exciting.

The next 12 months will be interesting to watch...